Irish Construction Activity Declines at Softer Pace

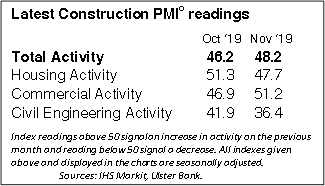

At 48.2 in November, up from 46.2 in October the Ulster Bank Construction Purchasing Managers’ Index® (PMI®) – a seasonally adjusted index designed to track changes in total construction activity – signalled a further contraction of Irish construction activity. That said, the rate of decline eased from October and was modest.

Commenting on the survey, Simon Barry, Chief Economist Republic of Ireland at Ulster Bank, noted that: “The latest results of the Ulster Bank Construction PMI survey signalled a third consecutive monthly decline in Irish construction activity. However, the pace of contraction eased last month as the headline PMI rose from 46.2 in October to 48.2 in November. This uptick reflected better performance in Commercial activity, with the Commercial PMI rising to a three-month high of 51.2 in November, in the process halting a two-month sequence of falling activity.

“Less encouragingly, further slippage in the residential activity sub-index took the Housing PMI to below 50 as survey respondents reported negative growth for the first time since June 2013. However, we note that official ‘hard’ data on residential construction, including housing starts and completions, continue to point to robust growth in the sector. Indeed, this divergence between the relative strength of ‘hard’ official measures of economic activity and the relative weakness of survey results is not confined to the housing sector. For example, trends in the official data on manufacturing production have held up well, despite recent weakness in the Manufacturing PMI. So, as with some other areas of the economy, we think that recent weakness in the Housing PMI is perhaps more reflective of large, adverse moves in business sentiment generally (likely related to acute Brexit uncertainty) than of marked weakness in actual underlying housing activity. In this respect, we wouldn’t be surprised to see some reversal of recent Housing PMI weakness in the months ahead, though we do think that the recent trend in the overall Construction PMI is pointing to downside risks to the construction outlook as we head into 2020.”

First decline in housebuilding since June 2013

For the first time since June 2013, construction companies registered lower residential activity levels during November, whilst commercial activity increased for the first time in three months. Meanwhile, civil engineering activity declined for the fifteenth consecutive month and at the fastest pace in almost six-and-a-half years.

For the first time since June 2013, construction companies registered lower residential activity levels during November, whilst commercial activity increased for the first time in three months. Meanwhile, civil engineering activity declined for the fifteenth consecutive month and at the fastest pace in almost six-and-a-half years.

Second consecutive decline in new orders

The contraction in overall activity was linked to a decline in inflows of new business. Irish construction firms recorded a second consecutive monthly decrease in new orders during November. The rate of contraction was modest, but quickened slightly from the previous month. Panellists stated that they had observed weaker overall demand conditions. Some firms noted that they had seen a decrease in new business due to Brexit uncertainty.

Employment growth at four-month high

In spite of declines in activity and new orders, Irish construction firms increased their workforce numbers again during November. Moreover, the rate of job creation was the fastest in four months. Anecdotal evidence from panellists indicated that greater workforce numbers sometimes stemmed from company expansion initiatives.

For the second time in the past three months, purchasing activity across the Irish construction sector declined in November. However, the rate of contraction was modest. Panellists indicated that they had decreased buying levels in response to receiving fewer customer orders.

Amid widespread reports of greater raw material prices (notably steel, insulation and fuel), input costs rose sharply during November. Moreover, the rate of inflation quickened from October to a seven-month high.

Looking ahead, business confidence was little changed from October’s three-month high, with around 29% of survey respondents anticipating activity to increase over the coming 12 months. Expectations of an increase in customer orders was among the reasons for positive sentiment. That said, the degree of optimism was below the series average, amid reports of Brexit uncertainty.