Softer Rise in Construction Activity Amid Storm Disruption

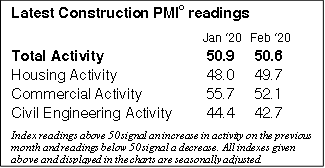

The Ulster Bank Construction Purchasing Managers’ Index® (PMI®) – a seasonally adjusted index designed to track changes in total construction activity – posted 50.6 in February, down slightly from 50.9 in January and signalling a modest increase in total construction activity in Ireland. Index readings above 50 signal an increase in activity on the previous month and readings below 50 signal a decrease.

The February expansion was the third in as many months, but the softest in this sequence. Where activity increased, panellists linked this to rises in new orders amid improving demand. On the other hand, stormy weather during February limited the pace of expansion.

Commenting on the survey, Simon Barry, Chief Economist Republic of Ireland at Ulster Bank, noted that: “The latest results of the Ulster Bank Construction PMI survey show a third consecutive monthly rise in Irish construction activity in February. However, the pace of expansion eased slightly last month as the headline PMI moderated from 50.9 in January to 50.6 in February, with respondents reporting that adverse weather limited the pace of expansion. The sub-sector detail shows that commercial activity continues to lead the expansion, with the February figures registering a fourth month of positive growth, albeit at a slower pace than in January. Meanwhile, the results on residential activity remained slightly disappointing, with the Housing PMI signalling a second consecutive monthly decline in activity. However, the contraction was only marginal and activity likely would have returned to expansion had it not been for the adverse weather last month.

“New business continued to rise at a healthy, though slower, rate in February as reduced Brexit-related uncertainty was again cited as a support for new orders. Furthermore, firms themselves remain optimistic about the coming year. While sentiment eased back a little last month from January’s one-year high, firms indicated that they were confident that new business would improve over the coming year, with almost 40% of respondents anticipating higher output levels in the coming 12 months. However, the global spread of the coronavirus represents a new important source of downside risk to the Irish economy as we look ahead, albeit that the mainly domestic-facing construction sector is perhaps less directly exposed to adverse virus impacts than the more heavily trade- and tourism-dependent areas of the economy. However, it is noteworthy that some impacts on construction are already being felt as some respondents mentioned the outbreak of the virus in China as a factor contributing to delays in deliveries from suppliers.”

Overall growth led by commercial activity

As was the case in January, the rise in total activity was driven by increased work on commercial projects as activity fell elsewhere. That said, growth in commercial activity softened. Housing activity decreased only marginally and to a lesser extent than in January, while civil engineering work fell markedly again.

As was the case in January, the rise in total activity was driven by increased work on commercial projects as activity fell elsewhere. That said, growth in commercial activity softened. Housing activity decreased only marginally and to a lesser extent than in January, while civil engineering work fell markedly again.

Further solid rise in new orders

New orders increased for the third month in a row during February. The rate of expansion was solid, albeit softer than that seen in January. Respondents pointed to improvements in customer demand, in some cases due to greater clarity around the near-term path for Brexit.

Supply-chain disruption evident

With new orders increasing solidly again, companies continued to expand their staffing levels and purchasing activity. Employment has now risen in each month throughout the past six-and-a-half years, although the latest increase was the slowest since last October. The rate of growth in input buying also softened in February.

Efforts to secure new inputs were hampered by suppliers’ delivery delays. Average lead times lengthened markedly, and to the greatest extent for seven months. According to respondents, longer delivery times generally reflected stormy weather during February, but there were some incidences of delays caused by the outbreak of coronavirus in China.

The rate of input cost inflation accelerated to a three-month high during February, with higher prices for raw materials such as concrete and metals mentioned. Higher insurance costs were also reported, along with unfavourable exchange rate movements.

The 12-month outlook for business activity remained positive, despite easing from January’s one-year high. Confidence stemmed from expectations that new orders will continue to rise over the coming year.