Irish construction sees sharper rises in activity

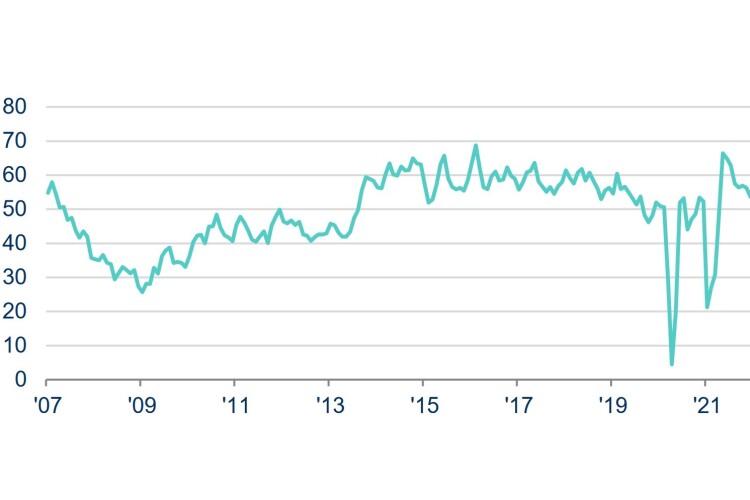

There have been sharper rises in activity and new orders as the Omicron wave of the Covid- 19 pandemic passed and demand improved. The findings come from the BNP Paribas Real Estate Ireland Construction Purchasing Managers’ Index (PMI), which is compiled by IHS Markit from responses to monthly questionnaires sent to a panel of around 150 construction companies.

Rising workloads and a jump in business optimism led companies to ramp up their purchasing activity and take on extra staff. Meanwhile, input costs continued to increase substantially amid severe disruption to supply.

The headline seasonally adjusted BNP Paribas Real Estate Ireland Construction Total Activity Index rose to 56.1 in January, up from 53.7 in December. Activity has now increased in nine successive months, with panellists mainly linking the latest rise to improving demand.

All three categories of construction recorded growth of activity in January, the third month running in which this has been the case. Commercial posted the fastest expansion as the rate of growth hit a three-month high.

Improvements in demand were evident with regards to new orders, which increased for the tenth successive month and at a faster pace than in December. Some firms specifically mentioned having received new work related to housing projects.

Positive expectations around future inflows of new work and greater confidence that the Covid-19 pandemic will not prove disruptive to operations during 2022 supported a sharp increase in business optimism. In fact, firms were at their most confident since the outbreak of the pandemic, with sentiment the strongest since August 2018. Exactly 57% of respondents were optimistic around the outlook.

This confidence, allied with an improving demand situation, encouraged construction firms to expand their staffing levels and purchasing activity during January. Employment increased for the tenth month running, and at a marked pace. The rate of growth in purchasing accelerated sharply, meanwhile, and was the fastest since July last year.

Efforts to secure inputs continued to be affected by severe disruption to supply chains, despite the latest instance of lengthening lead times being the least marked in 14 months. Where delivery times lengthened, firms linked this to rising demand for inputs alongside global material shortages and disruption caused by the pandemic.

Global material shortages continued to feed through to higher input costs, with increased charges for energy and shipping also reported. Input prices rose at a considerable pace, and one that was faster than in the previous month.

The usage of subcontractors by Irish construction firms increased in January, but there was again a sharp fall in their availability, thus contributing to a further steep rise in the rates they charged.

John McCartney, director & head of research at BNP Paribas Real Estate Ireland, said: “The key signal emerging from Irish construction firms in January is confidence. The Future Expectations Index reached 75.3 in January – its highest point in well over three years. But rising confidence can also be inferred from construction companies’ hiring behaviour. Employment in the panel of surveyed firms has been expanding month-on-month since April 2021, and the pace of hiring accelerated in January.

“Employers generally only on-board extra staff when they are confident that activity will be sustained so this, along with further growth in new orders during January, augurs well for construction activity in the months ahead.

“Consistent with the sharp rise in commencement notices since last March, home-building activity expanded at a quicker pace in January. But the sharpest acceleration occurred in commercial building where the activity index rose from 54.5 in December to 56.7 in January. Based on projects already on site, 2022 is expected to be the strongest year since the global financial crisis for Dublin office completions. There is also now increased logistics construction ongoing around Dublin as developers respond to a rising demand for storage space due to strong goods consumption and supply-chain reconfigurations.”

Source TheConstructionIndex