Call For Reduction in Stamp Duty For First-time Buyers

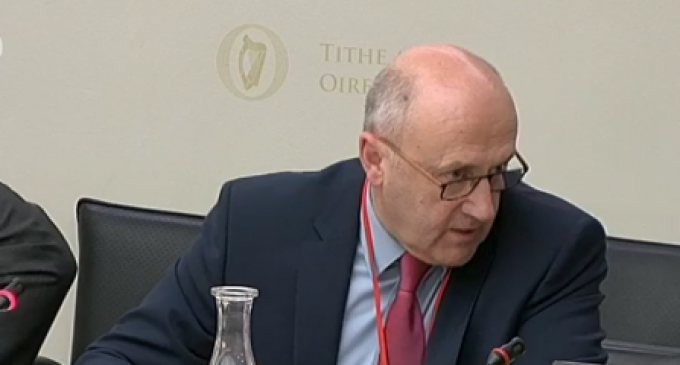

A call for stamp duty to revert to 2pc to enable more aspiring first-time buyers acquire once off sites to build homes has been called for by IPAV, the Institute of Professional Auctioneers & Valuers, which says last year’s hike from 2pc to 6pc is adversely affecting the cost of a new house for first-time buyers. Launching its pre-Budget submission, Pat Davitt (pictured), Chief Executive of the organisation which represents 1,300 auctioneers and valuers says the spike in the rate is exacerbating an already difficult situation.

“Affordability is a big challenge for the typical first-time buyer in their twenties and thirties,” he said. “With rising prices and the prudential requirement to have 10pc of the purchase price as a deposit, the stamp duty hike effectively means the State insists buyers have a huge and unrealistic level of savings when a 6pc contribution to the State is added for the privilege of a buying a site on which to build a home.

“That discourages young people and those with fewer resources from living in rural Ireland in particular. It’s typically impacting the local, nurse, garda or teacher,” he said.

A building site valued at €40,000 now has a stamp duty charge of €2,400, as opposed to €800 a year ago.

Pat Davitt said the Government needs to recognise the particular challenges faced by rural Ireland and the need to encourage young people in particular to live and work in rural Ireland.

IPAV’s submission also calls for VAT on building to be reduced from 13.5pc to 9pc and to be reviewed after two years. “The total tax take on a new house is estimated to be somewhere in the region of 40pc to 45pc of the cost of a property. All such charges are paid in full by the house buyer and impact affordability,” it says.

Concerns with the repeated delays in supplying rural broadband is also raised as a concern by IPAV. It warns “unless the plan can be successfully executed properties will lose value and in some areas will become unsaleable.”