Construction Activity Returns to Growth in December

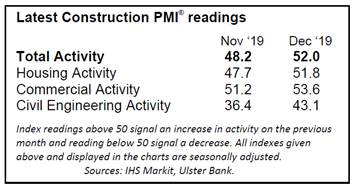

The Ulster Bank Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index designed to track changes in total construction activity – posted above the 50.0 no-change mark for the first time in four months during December. At 52.0, from 48.2 in November, the rise signalled a modest increase in construction activity.

Commenting on the survey, Simon Barry, Chief Economist Republic of Ireland at Ulster Bank, noted that: “The latest results of the Ulster Bank Construction PMI survey signalled a welcome return to expansion in Irish construction activity in December. Indeed, following a three-month sequence of falling activity, the headline PMI index rose sharply last month to get back to above the 50 break-even level for the first time since August. Reduced Brexit uncertainty was cited as a source of support for the increase in overall activity at the end of 2019, while the improvement also reflected better performance across the three main sub-sectors. Notably, a welcome pick-up in Housing activity saw it return to expansion in December, offering some support for our view that the recent weakness in the Housing PMI was perhaps more reflective of large, adverse, Brexit-related moves in business sentiment than of marked weakness in actual underlying housing activity. Meanwhile, commercial activity saw a further acceleration in its rate of expansion last month, in the process remaining the fastest-growing sub-sector.

“Overall, following disappointing readings over the previous three months, the pick-up in the December PMI is an encouraging sign that construction growth regained some growth momentum as 2019 drew to a close. And other details within the survey also offered encouragement. A notable pick-up in New Orders left the December reading back in positive growth territory, while respondents also indicated faster growth in demand for construction workers, with the pace of job creation rising to a six-month high in December. Moreover, the Future Activity Index rose to a six-month high in December, as confidence about the sector’s future prospects is being underpinned by expectations for availability of new projects in early 2020, while reduced uncertainty around Brexit was also cited as a source of support for the outlook.”

Residential activity increases

Housing activity rebounded in December, rising modestly following a first decline in almost six-and-a-half years in November. The sharpest expansion in activity was recorded on commercial projects, however, as the rate of growth accelerated from the previous month. Civil engineering activity continued to fall, albeit at a much softer pace and one that was the weakest since last May.

Housing activity rebounded in December, rising modestly following a first decline in almost six-and-a-half years in November. The sharpest expansion in activity was recorded on commercial projects, however, as the rate of growth accelerated from the previous month. Civil engineering activity continued to fall, albeit at a much softer pace and one that was the weakest since last May.

New orders return to growth

In line with the picture for total construction activity, new orders returned to growth. The solid increase in new business followed two months of decline.

Business sentiment at six-month high

Irish construction firms gained confidence at the end of the year, with optimism rising to a six-month high in December. Some panellists that forecast activity to rise over the course of 2020 mentioned that they expect new projects to commence in the coming months, while others indicated that reduced uncertainty around Brexit should help to support growth.

This confidence in the one-year outlook, coupled with rising activity in December, encouraged firms to expand their staffing levels further. Moreover, the rate of job creation was solid, having accelerated from that seen in November. Employment has now risen in each of the past 76 months.

Constructors also upped their input buying at a solid pace in December, with the increase at the end of the year following a modest decline in November.

Suppliers’ delivery times lengthened in December, with the rate of deterioration in vendor performance broadly in line with those seen during October and November. Some panellists indicated that increased online shopping meant that the availability of couriers had declined, thereby leading to delivery delays.

Finally, the rate of input cost inflation softened in December and was the slowest in three months. That said, input prices continued to increase at a marked overall pace. Respondents indicated that suppliers had raised their prices, with items such as oil, insulation and steel reported as increasing in cost.