Mortgage Approvals Increase by 30.7 Percent in Final Quarter of 2016

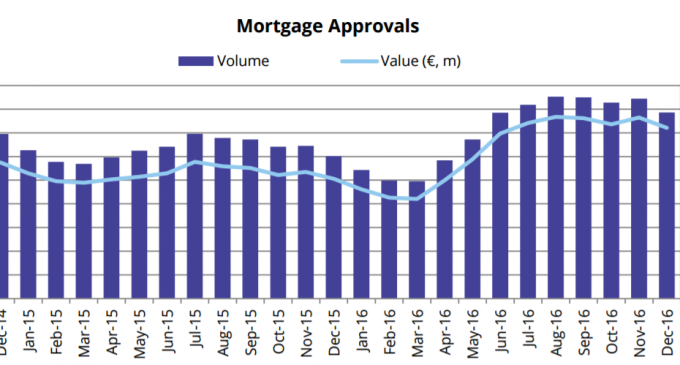

The number of mortgages approved in the three months ending December 2016 rose by 30.7% year-on-year and fell by 6.9% month-on-month, according to figures released by the Banking & Payments Federation Ireland on Friday.

The report also found that, during this time period, an average of 3,144 mortgages were approved per month. with 1,492 (47.4%) for first-time buyers (FTBs) while mover purchasers accounted for 1,029 (32.7%).

The value of mortgages approved was, on average, €641 million a month, and increase of 42.4% year-on-year, though dropping by 5.7% month-on-month. Of this, €295 million (46.0%) was accounted for by FTBs and €253 million (39.5%) by mover purchasers.

A total of 34,230 mortgage approvals, valued at €6.7 billion, were reported during 2016, based on the three-month moving average. This represented an overall year-on-year increase of 13% in volume and 20.2% in value.

The BPFI Mortgage Approvals Report December 2016 as well as the time series data file is available on the BPFI website here.