Structural Problems Still Haunt Property Market

Commenting on the latest CSO New Dwelling Completions, IPAV, the Institute of Professional Auctioneers & Valuers, said while going in the right direction with a 25% increase on 2017, it is well below 20,000, as predicted by IPAV.

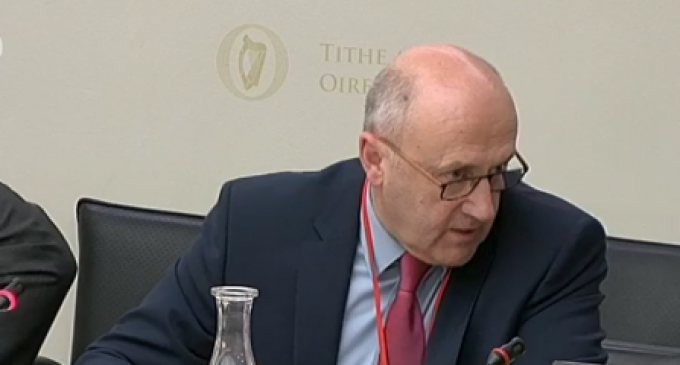

Pat Davitt (pictured), IPAV’s Chief Executive, said apartments at a very low 13% of the 18,072 new dwelling completions for 2018 point to the structural problems that “still haunt the property market.”

“More apartments are needed in the cities in particular where demand is greatest and affordability is an issue, but they are not coming on stream at the kind of levels needed,” he said. IPAV is in total agreement with the position of the Dáil’s Housing, Planning & Local Government Committee report which concludes that existing issues in the housing market could be worsened by Brexit.

“The structural issues around planning, the cost of building and the excessive cost of building finance for SME builders in particular remain as major impediments to the supply of homes which have become endemic since the financial crisis,” he said.

In welcoming the opening for business in January of the Home Building Finance Ireland €750 million fund first announced in October 2017, IPAV recently cautioned that for it to succeed the loan terms and administrative detail must not be over burdensome.

“It’s imperative that HBFI would be in a position to offer loans with interest rates under 5% if it is to succeed in bringing SME builders of badly needed residential homes back into the market. If the terms are unrealistic and don’t take cognisance of market conditions for SME builders then the loan scheme will be superfluous and only benefit those who don’t actually need it, who would already be in a position to acquire funding from existing sources,” he warned.